Simplifying the New Era of Investing!

With AI quantitative tools, say goodbye to complex

charts and overwhelming data, and step into a new

era of investing—streamlined, efficient, and effective!

LEARN MORE

15 Years of Experience in Financial Services.

We have an experienced team

It has more than a dozen

professional analysts.

Our mission is to assist

our clients in creating enduring

and stable value.

Our team possesses extensive

industry experience and unique

analytical capabilities

in the investment field.

We establish long-term

cooperative partnerships

with our clients and

always prioritize their interests.

About Horizon Wealth Management

We were established in 2009 and are a company dedicated to providing excellent investment advisory services. As a stock investment firm, we have a team of experienced and dynamic analysts, including over a dozen professional analysts.

Our mission is to help our clients achieve their investment goals and provide them with the best investment solutions. We firmly believe that through thorough research and professional investment management, we can create lasting value for our clients.

The Horizon Wealth Management team has decades of experience in the investment field and possesses specialized and unique analysis skills in stock investments. Our analysts constantly improve their knowledge and skills, with a deep financial background and extensive market knowledge ⋯

Seasoned Analysts

Thomas Carlson

Thomas Carlson is the founder and Chief Investment Officer of Horizon Wealth Management. Renowned for his sharp market insights and expertise in innovative quantitative trading, he has emerged as a leading figure in the investment industry. Over the past two decades, he has held several pivotal roles in the financial sector. Notably, he served as the Executive Vice President and Chief Investment Officer of Morgan Stanley’s Global Equity Beta Solutions, where he led the global investment strategy and execution team, contributing significantly to the firm’s impressive global returns. As one of the company’s core leaders, Thomas has played a critical role in shaping investment strategies and analyses. He currently oversees a diverse team of over 100 portfolio managers and analysts, managing more than 1,400 portfolios spanning equity indices and smart beta strategies, with total assets exceeding $500 billion. Under his leadership, he has spearheaded the development of AI-powered quantitative investment tools, delivering innovative financial strategies to investors worldwide. His achievements have earned him the trust and recognition of clients globally.

Victor Alexandre

Victor Alexandre, Chief Operating Officer of Horizon Wealth Management (HWM), brings extensive expertise in operations management and process optimization within the financial services industry. Known for his strategic mindset and hands-on approach, he oversees the company’s daily operations, ensuring seamless and efficient processes. Victor excels in streamlining workflows, boosting productivity, and fostering cross-functional collaboration—key contributions to HWM’s mission of delivering premier financial advisory services. Dedicated to operational excellence, he plays a pivotal role in maintaining the firm’s high service standards and driving its growth objectives.

Nora Henderson-Clark

Nora Henderson-Clark, Chief Financial Officer of Horizon Wealth Management (HWM), brings extensive expertise in financial management and strategic planning. Under her leadership, the company has achieved significant progress in budgeting, financing, financial analysis, and regulatory compliance. Nora oversees a broad spectrum of financial responsibilities, including reporting, cash flow control, and capital structure optimization. With a strong focus on risk management and internal operations, she has implemented rigorous processes to ensure financial stability and efficiently reduce risks. Additionally, she has driven improvements in internal management efficiency, ensuring optimal resource allocation to support the company’s long-term growth. Her expertise is instrumental in securing HWM’s financial stability and sustainable development.

Lukas Schneider

Lukas Schneider, Chief Risk Officer of Horizon Wealth Management (HWM), is a seasoned expert in financial risk management and regulatory compliance. With extensive experience in identifying, assessing, and mitigating risks, he is committed to strengthening HWM’s financial resilience. Lukas leads the development of risk management frameworks aligned with HWM’s strategic objectives, ensuring all business operations are focused on minimizing risks. His expertise in navigating complex regulatory environments, combined with his proactive approach to risk oversight, is vital to maintaining HWM’s adaptability in a dynamic financial landscape. His leadership is instrumental in upholding HWM’s commitment to excellence and prudent financial management.

Richard T. Flynn

Richard T. Flynn, Chief Technology Officer of Horizon Wealth Management (HWM), is an expert in utilizing innovative technologies to drive efficiency and innovation in the financial services industry. Drawing on his expertise in artificial intelligence and machine learning, he has played a key role in advancing HWM’s AI-powered quantitative investment tools. Richard’s vision and technical acumen have significantly strengthened HWM’s technological foundation, enabling personalized investment solutions and sophisticated market analysis. Dedicated to leveraging cutting-edge technologies, he ensures that HWM consistently delivers exceptional investment advisory services while maintaining its position at the forefront of financial innovation.

David Hunter

David Hunter, Chief Development Officer of Horizon Wealth Management (HWM), is a distinguished leader in business development and financing strategies. With extensive experience in financial growth initiatives and investor relations, he plays a critical role in expanding HWM’s market presence and establishing strategic partnerships. David’s expertise in securing capital support and driving financial growth is vital to HWM’s position as a leader in investment advisory services. By fostering strong relationships with investors and stakeholders, he helps ensure HWM’s continued growth and achievement of its strategic goals.

Grace McElroy

Grace McElroy, Chief Marketing Officer of Horizon Wealth Management (HWM), is a seasoned leader in marketing strategy and brand development. With extensive experience in the financial services industry, she oversees the company’s global marketing efforts, focusing on enhancing brand awareness and building strong relationships with clients and partners. Grace plays a pivotal role in showcasing the firm’s expertise, particularly in investment advisory services and advanced AI solutions. Her innovative approach and strategic vision have positioned HWM as a leader in the financial sector, driving growth and fostering client engagement through effective marketing initiatives.

Melinda Arifi

Melinda Arifi, Chief Human Resources Officer of Horizon Wealth Management (HWM), is an experienced leader in human capital management and organizational development. With extensive expertise in talent acquisition, employee relations, and leadership development, she oversees all aspects of the company’s HR operations. Melinda is dedicated to fostering a positive and inclusive work environment that supports the professional growth of team members. She excels at aligning HR strategies with business objectives, ensuring HWM attracts, retains, and nurtures top talent to drive the company’s success. Her dedication to employee well-being and development sustains a dynamic and motivated workforce at HWM.

CUSTOMIZED INVESTMENT STRATEGIES FOR CLIENT’S SPECIFIC NEEDS.

Market Report

2025/06/09

S&P 500 ends slightly up; traders watch US-China trade talks

Robinhood falls after platform left out of S&P 500 Warner Bros shares down after co said it plans to split businesses McDonald's falls after Morgan Stanley downgrade S&P 500 +0.09%, Nasdaq +0.31%, Dow flat

2025/06/06

Tesla's $380 billion wipeout marks biggest 2025 loss among top companies

June 6 (Reuters) - Tesla is the worst-performing large-cap stock this year, thanks to declining electric vehicle demand, Chief Executive Elon Musk's political controversies over his ties to far-right groups, and now, his public feud with President Donald Trump. Tesla shares slumped on Thursday, after Trump on social media threatened to cut off government contracts with Elon Musk's companies, following Musk's sharp criticism of the president's signature tax and spending bill on his X social media platform.

2025/06/05

Trump, Musk public feud escalates; Nasdaq falls; Tesla, DJT tumble

NEW YORK, June 5 (Reuters) - President Donald Trump threatened on Thursday to cut off government contracts with companies owned by billionaire Elon Musk, as the alliance between the world's most powerful man and its richest erupted into a rancorous public fight. The feud, which exploded in spectacular fashion over the course of a few hours, pushed shares of electric vehicle maker Tesla (TSLA.O), opens new tab down dramatically. The company, where Musk serves as chief executive officer, closed down 14.3% for the day and lost about $150 billion in value after Trump and Musk began their war of words.

2025/06/04

Safe-haven gold rises on weak data, simmering uncertainty

Trump calls China's Xi tough, 'hard to make a deal with' US private payrolls post smallest gain in over two years in May US service sector unexpectedly contracts in May Dollar down 0.5%

2025/06/03

Morning Bid: Trump and Xi's big chat

LONDON, June 3 (Reuters) - What matters in U.S. and global markets today The dollar and U.S. Treasuries found their footing on Tuesday after a rough start to the week, but stocks remained edgy due to a mix of trade war concerns and spluttering factory activity.

2025/06/02

Wall Street closes with modest gains, dollar weakens as trade tensions flare

Trade tensions between US and China escalate, affecting global markets Trump plans to double tariffs on steel and aluminum, EU vows retaliation Dollar weakens amid unpredictable trade policy, Treasury yields rise slightly Oil bounces on Canada wildfires, output relief from OPEC

2025/05/26

Gold falls nearly 1% after Trump extends tariff deadline on EU goods

Trump extends EU trade talk deadline to July 9 Citi upgrades its zero-to-three month gold price target Markets in the United States and Britain closed

2025/05/23

Wall St falls as Trump tariff threats spark market uncertainty

Indexes down: Dow 0.61%, S&P 500 0.67%, Nasdaq 1% Deckers Outdoor slumps after sales fall below estimates Apple hits two-week low after Trump threatens tariffs Wall Street's 'fear gauge' spikes to over two-week high

2025/05/22

Kraken launches tokens to offer 24/7 trading of U.S. equities

Crypto exchange Kraken said on Thursday it is launching tokens of U.S. equities that will trade around the clock, giving non-U.S. investors exposure to high-profile companies such as Apple (AAPL.O), opens new tab, Tesla (TSLA.O), opens new tab and Nvidia (NVDA.O), opens new tab. Tokenization refers to the process of issuing digital representations of publicly-traded securities. Instead of holding the securities directly, investors hold tokens that represent ownership of the securities.

2025/05/21

Morgan Stanley turns bullish on most US assets, except dollar

Morgan Stanley turned bullish on most major U.S. assets, upgrading its stance on stocks and Treasuries to "overweight", bolstered by reduced tariff uncertainty, no chance of a recession and the room for further rate cuts. However, the one exception was the dollar, which the Wall Street brokerage expects will continue to remain under pressure due to "a convergence in U.S. rates and growth to peers", it said in a note late on Tuesday.

2025/05/20

Dollar set for more weakness as 'Brand USA' falls further out of favor

Investors still see dollar as overvalued even after recent fall Further rebalancing of global portfolios away from USD assets poses risk to the buck Rise in FX hedge ratios could add selling pressure Some investors looking to sell dollar rallies

2025/05/19

JPMorgan upgrades emerging market equities as Sino-US trade war eases

J.P.Morgan upgraded its rating on emerging market equities to "overweight" from "neutral" on Monday, citing easing U.S.-China trade tensions and a softer dollar. Last week, the U.S. and China agreed to a 90-day tariff reduction, with the U.S. cutting duties on Chinese goods to 30% from 145% and China lowering tariffs on U.S. imports to 10% from 125%, fuelling hopes of easing global trade tensions.

2025/05/16

US stock market gains may slow after torrid rebound from tariff swoon

S&P 500 erases losses for year after US-China trade truce P/E ratio on S&P 500 reaches two-month high 2025 corporate profit growth estimates trend lower since January

2025/05/15

Oil prices drop on US-Iran progress; global shares gain in choppy trade

Oil prices tumble Fed chair warns of a period of 'more frequent' shocks European shares recover to end higher

2025/05/14

S&P 500 barely gains, investors focus on trade, wait for data

Indexes mixed: Dow off 0.21%, S&P 500 up 0.10%, Nasdaq up 0.72% American Eagle Outfitters drops after withdrawing FY forecast AMD gains after announcing $6 billion buyback plan

2025/05/13

Gold rebounds on bargain-hunting, softer US inflation data

US consumer price index increased 0.2% last month Markets expect Fed to resume policy easing in September US and China on Monday agreed to pause trade war

2025/05/12

Stocks, dollar surge as US and China agree 90-day tariff relief

U.S. and China reach deal to temporarily slash tariffs Wall Street stocks leap Dollar jumps 2% against Japanese yen, Swiss franc tumbles Gold drops sharply after stunning rally, government bonds weak

2025/05/09

Wall St closes near flat with focus on US-China talks

Fed officials: tariffs to boost inflation, slow growth this year Expedia falls after soft US travel demand leads to revenue miss Trump suggests 80% tariffs on Chinese goods, currently at 145% Indexes: Dow down 0.29%, S&P off 0.07%, Nasdaq flat

2025/05/09

Pinterest shares surge as strong ad spend defies tariff uncertainty

Pinterest (PINS.N), opens new tab shares jumped more than 11% on Friday, after a strong quarterly revenue forecast allayed investor jitters about the uncertainty of advertising spending on its platform amid global economic volatility. Its robust first-quarter revenue positions it alongside peers Reddit (RDDT.N), opens new tab and Facebook-parent Meta (META.O), opens new tab, which also saw strong top-line results at a time when deepening global trade tensions have clouded the outlook for many firms dependent on marketing spend.

2025/05/08

Equities rise with dollar, bond yields on trade optimism after US-UK deal

Equities rise after US-UK trade deal announcement Investors eye US-China weekend talks US dollar advances with bond yields, oil settles up BoE cuts UK rates, Sweden and Norway hold rates

2025/05/07

Stocks rise in choppy trade after Fed keeps rates unchanged

Fed keeps rates steady but eyes rising price, unemployment risks U.S., China to discuss trade in Switzerland at weekend Dollar rises, European stocks fall U.S. stock indexes end choppy session higher with late rally

2025/05/07

US, China to hold ice-breaker trade talks in Geneva on Saturday

Bessent, Greer will hold trade talks with China's He Lifeng Stock markets lifted by prospect of tensions easing U.S.-China tariffs "the equivalent of an embargo", Bessent says China injects new monetary stimulus to combat tariff blow

2025/05/06

S&P 500 futures rise on trade deal optimism

U.S. stock futures rose late on Tuesday after it was announced that Treasury Secretary Scott Bessent and U.S. Trade Representative Jamieson Greer would meet with China's top economic official later this week in Switzerland.

S&P 500

2025/05/05

S&P 500 snaps 9-session win streak after latest Trump tariff

Berkshire Hathaway falls after Buffett to step down as CEO US service sector picks up in April Skechers jumps after $9 billion take-private deal Indexes off: Dow 0.24%, S&P 500 0.64%, Nasdaq 0.74%

2025/05/02

Block's shares tumble after 2025 profit forecast cut defies sector trends

shares fell 22% on Friday and were on track for the biggest intraday decline in five years after a 2025 profit forecast cut raised concerns about the payment firm's key businesses. The selloff wiped off nearly $8 billion from the Jack Dorsey-led company's market value. At least eight brokerages reduced their price targets on the stock, citing weakness in the company's peer-to-peer Cash App and mounting competition.

2025/05/01

Gold slips to 2-week low on trade talk hopes, China holiday

Trump says 'potential deals' with India, South Korea, Japan possible U.S. economy shrinks in first quarter of fiscal 2025 U.S. nonfarm payroll report due on Friday

2025/04/30

Meta, Microsoft reports lift AI-related stocks

Shares in artificial intelligence and cloud-computing-related companies were rising sharply in late trade on Wednesday after Meta Platforms (META.O), opens new tab and Microsoft (MSFT.O), opens new tab results beat Wall Street expectations. The reports appeared to boost demand for shares in AI chip leader Nvidia Corp (NVDA.O), opens new tab, which rose 2.8% in late trading, and chip rival Advanced Micro Devices (AMD.O), opens new tab, which rose 2%.

2025/04/29

HSBC becomes latest brokerage to cut S&P 500 annual target below 6000 mark

April 29 (Reuters) - HSBC on Tuesday became the latest global brokerage to slash its year-end target for the S&P 500 index (.SPX), opens new tab below the 6000 mark, weighed down by slower U.S. economic growth and tariff-related pressure on corporate earnings. The London-based brokerage cut its target to 5600 from 6700, which is in line with BofA Global Research's forecast.

2025/04/28

Take Five: Trump's first 100 days

April 25 (Reuters) - Donald Trump is nearing the 100-day mark of his second presidency and investors are no closer to figuring out how to trade his policies, nor do central bankers have much clarity on how their economies may be affected. Additionally, earnings season is ramping up, there's crucial U.S. jobs data, a Canadian election and a litmus test for the health of the euro zone.

2025/04/25

Stocks rise with tech-related shares, notch weekly gains; dollar up

Dollar edges up against euro and yen Alphabet rises on better-than-expected profit Nasdaq ends up more than 1%

2025/04/24

Drugmakers brace for Trump tariffs with production shifts

Companies consider production shift Roche in talks for import tariff exemptions Merck includes $200 million tariff impact in outlook Levies could disrupt supply chain, patient access, firms warn

2025/04/23

Stocks, dollar climb, gold sinks as US says China tariffs not sustainable

US stocks end higher amid tariff optimism Trump softens tone on Fed Chair Powell Dollar bounces against euro, other currencies

2025/04/22

Gold takes a breather after hitting $3,500 on higher stocks, stronger dollar

Bullion hits record high of $3,500.05/oz U.S. dollar up 0.7% U.S. Treasury Secretary says tariff standoff with China unsustainable

2025/04/21

Wall St ends sharply lower following Trump's anti-Powell tirade

Indexes down: Dow 3.19%, S&P 500 3.27%, Nasdaq 3.48% Trump's criticism of Powell raises concerns over Fed's independence Sino-U.S. trade tensions deepen, affecting global tariff negotiations Tesla slips after report of delay in Model Y launch FIS jumps after brokerage upgrade

2025/04/20

Wall St Week Ahead: Busy US earnings week confronts market grappling with tariff fallout

Tesla, Alphabet first of Magnificent 7 megacaps set to report Boeing, Merck, Intel among other companies due next week Focus also on Fed, after Trump slams chair over rates

2025/04/17

Pluxee doubles margin growth forecast for 2025, shares jump

French voucher and benefits company Pluxee (PLX.PA), opens new tab doubled its margin growth forecast for 2025 on Thursday, as strong new client acquisitions drive performance exceeding the targets set in its three-year strategic plan. The company's shares rose 12% by 0839 GMT, topping the SBF 120 (.SBF120), opens new tab index of Paris' most traded stocks.

2025/04/16

Global chipmakers feel the pinch of Trump's shifting trade policy

Global chip stocks were battered on Wednesday on fresh evidence of how U.S. President Donald Trump's shifting trade policy was complicating the outlook for semiconductor and computing giants, including AI pioneer Nvidia (NVDA.O), opens new tab and its rival AMD (AMD.O), opens new tab. Attempts to reorient global trade through tariffs and export curbs have started to show the effect as Nvidia warned of a $5.5 billion hit after Washington restricted exports of its AI processor tailored for China, while Dutch chip-making tools giant ASML raised doubts about its outlook.

2025/04/15

Wall Street ends down slightly; tariff uncertainty keeps investors on edge

Bank of America gains after higher Q1 profit Uncertainty over the outlook for tariffs still high Indexes: Dow down 0.4%, S&P 500 down 0.2%, Nasdaq down 0.1%

2025/04/15

Gold climbs as softer dollar, tariff tensions buoy demand

Gold hit record high of $3,245.42 on Monday Dollar languishes near three-year low Palladium rises more than 1%

2025/04/14

Citigroup downgrades US equities, cuts S&P 500 target below 6000 on tariff concerns

April 14 (Reuters) - Citigroup downgraded its stance on U.S. equities and slashed its S&P 500 index target for this year as it expects tariff uncertainty to hurt corporate America's earnings. Citi joined a string of brokerages, including Goldman Sachs and BofA, in slashing their benchmark index target below the 6000 mark.

2025/04/11

Gold soars past $3,200 as trade war deepens, dollar loses ground

Bullion is up over 6% this week China raised tariffs on U.S. imports to 125% U.S. monthly producer prices unexpectedly fell in March

2025/04/10

US stocks, dollar drop on lingering tariff worries, a day after relief rally

US stocks fall after Wednesday's rally, with S&P 500 down 3% Europe, Asia stocks end higher after Trump pauses most tariffs Bond market rout stabilizes while gold prices hit high

2025/04/09

In stunning U-turn, Trump walks back some tariffs, triggering historic market rally

Trump announces sudden reversal on tariffs Most country-specific tariffs paused, but duties raised on China imports US Treasury Secretary Bessent says strategy is deliberate Stocks rise sharply, but uncertainty remains

2025/04/08

S&P 500 hits lowest close in almost a year as hopes wane for tariff concessions

Indexes fall: Dow 0.84%, S&P 500 1.57%, Nasdaq 2.15% S&P 500 markets biggest 4-day loss since its creation Major health insurers rise after Medicare payment rate boost Big bank earnings set to begin later this week

2025/04/07

BofA, Oppenheimer latest on Wall St to slash S&P 500's annual target

April 7 (Reuters) - BofA Global Research and Oppenheimer Asset Management on Monday became the latest Wall Street research firms to cut their year-end targets for the S&P 500 index to below the 6,000 mark in response to risks from a deepening global trade war. Oppenheimer reduced its target for the benchmark index (.SPX), opens new tab to 5,950 from 7,100 target, while BofA reduced to 5,600 from 6,666, making it one of the lowest on Wall Street.

2025/04/04

Financial markets face fear, shellshock as global trade war looms

Wall Street 'fear gauge' closes at 5-year high Nasdaq enters bear market as stocks slump over 10% in two days Euro volatility spikes, dollar swings amid tariff news FX and bond market volatility jump US sovereign credit default swaps on the rise

2025/04/03

Wall Street ends with heavy losses on fears Trump tariffs will trigger recession

All three benchmarks slump after Trump tariffs announcement Apple leads declines among Big Tech Retail stocks sink on Asia tariff worries Wall Street fear gauge hits 3-week high

2025/04/03

Trump's tariffs provoke trade war threats, fears of pricier iPhones

Trump officials defend 10% base tariff on imports Stock markets have worst day since 2020 as recession fears mount Canada institutes countermeasures, China and EU say they will follow See Reuters Live coverage on the tariffs here

2025/04/02

Wall Street ends up, but Trump tariff speech sends futures lower

Trump unveils 10% baseline tariff on all imports at key speech S&P, Nasdaq futures reverse gains, portend big drops on Thurs Indexes up before speech: Dow 0.56%, S&P 500 0.67%, Nasdaq 0.87%

2025/04/01

CoreWeave shares soar past IPO price on third trading day

Artificial intelligence startup CoreWeave's (CRWV.O), opens new tab shares closed up 42% at $52.57 on Tuesday, their third day of trading, above their initial public offering price of $40. At close, the company added more than $7 billion to its market value.

2025/03/31

Trading Day: Wall Street shakes off tariff trepidation

NEW YORK, March 31 (Reuters) - Making sense of the forces driving global markets Jamie is enjoying some well-deserved time off, but the Reuters markets team will still keep you up to date on what moved markets today.

2025/03/31

Aston Martin gets $162 million funding boost to counter losses, Trump tariffs

Yew Tree Consortium to invest 52.5 million pounds Chairman Stroll's stake to rise to 33%, eyes up to 35% Aston Martin revises volumes forecast due to tariff impact

2025/03/28

Gold prices soar to all-time high over trade war concerns

Spot gold hits 18 record highs so far this year US PCE at 0.4% in February Silver, platinum & palladium headed for weekly gain

2025/03/27

Trump's auto tariffs will hit many companies, but Elon Musk's Tesla less so

Tesla less affected by tariffs due to domestic production Tesla imports some parts, but less reliant on foreign components Musk's ties to Trump may impact Tesla's global reputation

2025/03/26

GameStop's crypto pivot boosts shares of one-time retail investor favorite

March 26 - GameStop (GME.N), opens new tab jumped on Wednesday as the shares that were once at the center of "meme stock" trading frenzy caught investor attention again with the video game retailer making its move into cryptocurrencies. The company's shares rose 12% before the bell after GameStop said it would invest in bitcoin, with its primary brick-and-mortar retail business struggling to draw customers amid the prevalence of digital downloads and e-commerce.

2025/03/25

Stocks edge higher, US dollar slips as tariff uncertainty weighs

Dollar dips after hitting three-week high Stocks rise modestly after strong rally German business sentiment improves

2025/03/24

Stocks jump, US Treasury yields climb on tariff optimism

Major U.S. indexes up more than 1% Reports suggest Trump tariffs may be targeted Bostic sees only one Fed cut this year

2025/03/21

Dow, S&P end flat, Nasdaq snaps four-week decline on tariff hopes

Nike dips on bleak revenue outlook FedEx tumbles after results, outlook Boeing jumps after fighter jet contract award Indexes up: Dow 0.08%, S&P 0.08%, Nasdaq 0.52%

2025/03/21

Gold dips on higher dollar, still eyes third weekly gain

Gold hit record high of $3,057.21/oz on Thursday Silver, platinum, palladium poised for weekly declines US dollar hit its highest level since March 7

2025/03/20

Elon Musk issued summons in SEC case over Twitter stake disclosure

March 20 (Reuters) - Elon Musk, the world's richest man and a top adviser to U.S. President Donald Trump, was issued a summons in connection with the Securities and Exchange Commission's lawsuit against him, a court filing on Thursday showed. A process server gave the civil summons and other documents on March 14 to a security guard at the Brownsville, Texas, headquarters of SpaceX, the space technology company of which Musk is CEO, the filing said. An answer is due on April 4, according to the docket.

2025/03/19

Gold soars to record high after Fed holds rates steady, signals two cuts in 2025

Spot gold hits an all-time high of $3,051.99/oz US rate futures price in two rate cuts in 2025 Fed likely to resume rate cuts in June

2025/03/18

Wall Street ends lower on tariff worry as Fed decision eyed

Nvidia falls as annual software developer conference gets underway Tesla drops after RBC lowers price target Alphabet declines after $32 billion deal to buy Wiz Indexes down: Dow 0.62%, S&P 500 1.07%, Nasdaq 1.71%

2025/03/17

Trading Day: Global rebound enters day two, Wall St lags

ORLANDO, Florida, March 17 (Reuters) - Making sense of the forces driving global markets Global equity markets on Monday kept up the positive momentum initiated by Friday's rebound, as investors parked their concerns over escalating global trade tensions and hoovered up cheap and beaten down stocks.

2025/03/16

Wall St Week Ahead Fed on tap for tariff-jolted market as investors look for calm

Fed expected to hold rates steady on Wednesday Markets expect more easing later in 2025 Tariff news expected to stay at forefront for stocks

2025/03/14

Gold pops above $3,000/oz for first time in historic safe-haven rally

Cenbank gold buying will remain structurally higher, Goldman says Spot gold hits record high of $3,004.86 US central bank policy meeting due next week

2025/03/14

Stocks suffer biggest weekly outflow this year in 'risk-off' move, BofA says

LONDON, March 14 (Reuters) - Investors pulled $2.8 billion from stock funds in the week to Wednesday in the biggest weekly outflow this year, Bank of America said on Friday, in a sign of a souring of the mood in global financial markets. The U.S. S&P 500 (.SPX), opens new tab stock index has now fallen more than 10% from its recent high, putting it into correction territory, as U.S. President Donald Trump's stop-start trade wars sow uncertainty among companies and investors.

2025/03/13

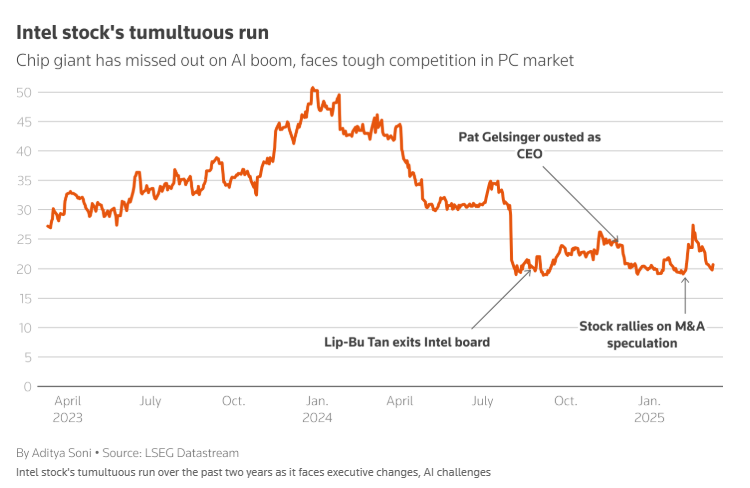

Intel jumps nearly 15% as investors cheer appointment of new CEO Tan

Tan tasked with reviving Intel after AI-driven semiconductor boom missed Analysts optimistic about Tan's deep relationships in chip ecosystem Intel's market value stuck below $100 billion, analysts recommend 'hold' rating

2025/03/12

S&P 500, Nasdaq end higher as cool inflation data calms tariff jitters

Intel jumps on report TSMC pitched JV to US chipmakers PepsiCo drops on brokerage downgrade CPI shows inflation cooled more than expected in February Indexes: Dow off 0.20%, S&P 500 up 0.49%, Nasdaq gains 1.22%

2025/03/12

Wall St set to open higher as US inflation cools, but slowdown fears loom

Futures up: Dow 0.54%, S&P 500 1.0%, Nasdaq 1.44% Intel jumps on report TSMC pitched JV to US chipmakers February CPI rises 2.8%, lower than estimates

2025/03/11

Trump says he will label violence against Tesla domestic terrorism

Tesla shares rise 4% after Trump's support for Musk Protests against Tesla linked to Musk's political role Musk pledges to double Tesla production in two years

2025/03/11

Trump defends tariffs, meets corporate America as economic fears nip stocks

Business Roundtable has pushed for end to Trump trade war Meeting follows US stock market selloff Companies try to size up Trump's economic impact

2025/03/10

US stock market loses $4 trillion in value as Trump plows ahead on tariffs

S&P 500 down over 8% from Feb 19 all-time high Nasdaq confirmed 10% correction from its Dec peak last week S&P 500 P/E moderates but still high vs historical average Delta Air Lines cuts forecast on growing economic uncertainty Tesla loses more than $125 bln in value in one day

2025/03/10

Oil settles down 1.5% as tariffs prompt fears of slow demand

WTI and Brent benchmarks register multiple weekly declines IEA and OPEC monthly reports expected this week Saudi Aramco cuts crude prices to Asia

2025/03/07

Wall St ends higher after Fed chief's comments, but posts big weekly loss

Hewlett Packard slumps after dour second-quarter forecasts Costco falls after retailer misses estimates Nonfarm payrolls increase by 151,000 in February

2025/03/07

Iron ore ticks up, but posts weekly loss on tariff woes

SINGAPORE, March 7 (Reuters) - Dalian iron ore futures logged a weekly fall on Friday, despite snapping a nine-session losing streak on the day, weighed down by reports of steel production cuts in China and an intensifying trade war between Washington and Beijing. The most-traded May iron ore contract on China's Dalian Commodity Exchange (DCE) added 0.19% to 774 yuan ($106.81) a metric ton. The contract fell 3.49% this week. The benchmark April iron ore on the Singapore Exchange was 0.04% higher at $100.4 a ton, losing 1.99% so far this week as of 0712 GMT.

2025/03/06

As US chip darlings struggle, some bet on software as next big AI play

March 6 (Reuters) - U.S. chip stocks were the biggest beneficiaries of last year's artificial intelligence investment craze, but they have stumbled so far this year, with investors moving their focus to software companies in search of the next best thing in the AI play. Tariff-driven volatility and a dimming demand outlook following the emergence of lower cost AI models from China's DeepSeek have shifted the spotlight away from semiconductor shares.

2025/03/05

US services sector expands; price growth accelerates amid tariffs

Services PMI increases 0.7 point to 53.5 in February Prices paid, new orders, employment measures rise Tariffs, federal government spending cuts causing anxiety Private payrolls rise 77,000, smallest gain since July

2025/03/04

Nasdaq nears correction territory dragged down by trade tensions

Ford and General Motors fall Target drops on bleak FY forecast Walgreens jumps on reports of take-private deal Indexes down: Dow -1.55%; S&P 500 -1.22%; Nasdaq -0.35%

2025/03/03

How would a US crypto strategic reserve work?

WASHINGTON, March 3 (Reuters) - U.S. President Donald Trump has given a first glimpse into what a U.S. cryptocurrency reserve could look like, saying the stockpile would include bitcoin and ethereum and a range of smaller tokens. Trump in January signed an executive order for the creation of a digital asset working group to explore the possibility of a strategic bitcoin reserve. Trump had directed the group to turn in a report by July addressing criteria for such a stockpile, potentially derived from cryptocurrencies seized by the federal government.

2025/03/02

Wall St Week Ahead Rising investor angst about economy to be tested by US jobs data

February jobs report due on March 7, increase of 133,000 jobs expected Weakening US consumer, business indicators signal caution Investors assessing fallout from Trump plans to shrink federal workforce

2025/02/28

Gold set to record worst week in three months on robust dollar

US PCE at 0.3% in January Gold still poised for second straight monthly gain Silver, platinum, palladium set for monthly losses

2025/02/28

US consumer spending posts first drop in almost two years

Consumer spending drops 0.2% in January PCE price index increases 0.3%; up 2.5% year-on-year Core PCE inflation rises 0.3%; gains 2.6% year-on-year Goods trade deficit jumps 25.6% to record $153.3 billion

2025/02/27

Why the US exceptionalism trade is faltering

Weakening US consumer, business indicators signal caution S&P 500 underperforms global rivals this year, dollar down from Jan peak Tech sector struggles weigh on US stock performance

2025/02/26

Morning Bid: Confidence-sapped stocks find foothold as Nvidia awaited

A look at the day ahead in U.S. and global markets from Mike Dolan Hit by draining consumer and business confidence amid uncertainty about Washington's economic policies, Wall Street stock indexes are all tripping into the red for 2025 - with the slide stalling for now, awaiting megacap Nvidia's earnings today. The latest sideswipe from main street has unnerved stock, bond and credit markets across the piece.

2025/02/25

Wall Street ends mixed in the face of mounting uncertainties

Consumer confidence posts biggest drop in 3-1/2 years Nvidia dips ahead of Wednesday earnings Lilly up on launching higher-dose, discounted Zepbound vials Indexes: Dow up 0.37%, S&P 500 off 0.47%, Nasdaq down 1.35%

2025/02/24

Nasdaq, S&P 500 fall as AI caution weighs on tech, Nvidia results in focus

Nike gains after Jefferies upgrades to 'buy' Berkshire Hathaway hits record high after record Q4 profit Nvidia, Microsoft close lower Indexes: Dow up 0.08%, S&P 500 down 0.50%, Nasdaq down 1.21%

2025/02/22

Warren Buffett sounds warning to Washington as Berkshire reports record profit, cash

Buffett says Uncle Sam should take care of less fortunate Washington warned to avoid 'fiscal folly' Operating profit sets record, annual meeting shortened

2025/02/21

Wall Street ends sharply lower on mounting concerns over economy, tariffs

Indexes post steep weekly percentage losses Consumer sentiment sours, inflation expectations rise UnitedHealth drops after report of DOJ investigation Indexes down: Dow 1.69%, S&P 500 1.71%, Nasdaq 2.20%

2025/02/20

Morning Bid: Trade and Ukraine tensions mount, with Fed twist

A look at the day ahead in U.S. and global markets from Mike Dolan World markets were subdued on Thursday by simmering trade tensions and Washington's attempt to undermine its Ukrainian ally, while the Federal Reserve surprised with talk of slowing its balance sheet runoff at its recent meeting. A messy week of conflicting geopolitical, trade and central banking headlines has seen renewed tariff threats from President Donald Trump, a bizarre twist in U.S./Russia talks to end the Ukraine war and mix of interest rate cuts and hawkishness in global monetary policy.

2025/02/19

Gold eases as dollar holds ground, focus on Trump tariffs

Gold hit a record high of $2,946.85/oz earlier in the session Trump says he will introduce 25% tariffs on autos Fed wary of inflation at its January meeting as firms eyed price hikes

2025/02/18

S&P 500 ekes out all-time closing high as Fed minutes eyed

Constellation Brands jumps after Berkshire discloses stake Intel up after report Broadcom, TSMC eye deals to split it Meta Platforms snaps 20-session winning streak Fed's January meeting minutes due on Wednesday Indexes up: Dow 0.02%, S&P 500 0.24%, Nasdaq 0.07%

2025/02/18

Tiger Brokers adopts DeepSeek model as Chinese brokerages, funds rush to embrace AI

Tiger Brokers integrates DeepSeek-R1 model into its AI chatbot Chinese brokers, funds rush to capitalize on DeepSeek breakthrough AI to reshape China's financial industry, boosts IT spending, UBS says

2025/02/17

Ukraine ceasefire hopes offer Europe's markets a tailwind in the shadow of tariffs

Euro, stocks perk up on potential for Ukraine ceasefire Market impact depends on extent of Russian gas flow recovery Optimism may be not enough to ease tariff fears

2025/02/16

Wall St Week Ahead Walmart to shed light on consumer health as inflation bites, tariffs swirl

NEW YORK, Feb 14 (Reuters) - Walmart's quarterly report in the coming week will give investors fresh insight into the health of U.S. consumers, who are facing stronger inflation and uncertainty over whether President Donald Trump's tariffs will push up prices. The benchmark S&P 500 stock index (.SPX), opens new tab was up about 1% for the week, with stocks showing resilience despite a hot report on consumer prices that led investors to push back expectations of further interest rate cuts this year.

2025/02/14

Wall Street ends mixed; Nvidia lifts Nasdaq

Airbnb rises on upbeat quarterly results DaVita falls after Q4 results; Berkshire Hathaway cuts stake January retail sales at -0.9% MoM vs -0.1% estimate S&P 500 -0.01%, Nasdaq +0.41%, Dow -0.37%

2025/02/13

Wall Street ends higher after Trump unveils tariff plan

Trade Desk falls on downbeat Q1 revenue forecast MGM Resorts up after Q4 results beat estimates White House says tariffs could come in weeks S&P 500 +1.04%, Nasdaq +1.50%, Dow +0.77%

2025/02/12

Gold steadies as trade war concerns lend support

US consumer price index jumped 0.5% last month Bullion off a record high of $2,942.70 hit on Tuesday Trend remains positive for gold amid trade concerns - analyst

2025/02/11

Morning Bid: Powell and Steel, with AI in play

A look at the day ahead in U.S. and global markets from Mike Dolan Old and new economy stocks keep Wall Street pumped up this week as tech and steel sectors advance on a mix of tariff news and an artificial intelligence buzz, with Treasuries in thrall to Federal Reserve boss Jerome Powell's latest trip to Congress. U.S. President Donald Trump raised tariffs on steel and aluminum imports on Monday to a flat 25% "without exceptions or exemptions," in a move he hopes helps struggling U.S. firms in the sector but which risks sparking a multi-front trade war.

2025/02/10

Investors return to new-look Middle East, but Trump causes some concern

Historic political shake-up of region encouraging investors Ceasefire expected to take pressure off Israel's finances Major funds increasing positions in Egypt Hopes for resolution of Lebanon's crisis driving up its bonds

2025/02/09

Wall St Week Ahead Inflation data to test market as tariff talk swirls

NEW YORK, Feb 7 (Reuters) - A fresh look at the pace of inflation will test the U.S. stock market in the coming week, as investors worry that President Donald Trump's tariff plans are endangering Wall Street's hopes for interest rate cuts this year. The benchmark S&P 500 (.SPX), opens new tab remained about 1% below record-high levels, even as stocks were whipsawed this week by headlines over Trump's plans to impose tariffs on the largest U.S. trading partners.

2025/02/07

Trump's tariff roulette: The markets left reeling from trade threats

Trump tariff risk still tops market worry list Canadian dollar, euro could weaken more: analysts Autos sector firmly in losing camp too China's yuan buffered for now

2025/02/06

Qualcomm shares fall on downbeat forecast for licensing business

Feb 6 (Reuters) - Shares of chipmaker Qualcomm (QCOM.O), opens new tab fell about 5% in early trading on Thursday as a weak outlook for its patent licensing business outweighed strong expectations for quarterly sales and profit. The company disappointed investors after it said the licensing business, which accounted for 14.8% of its total revenue in the reported quarter, would see no sales growth this year following the expiration of its agreement with Huawei Technologies (HWT.UL).

2025/02/05

Wall St ends higher as investors digest earnings, rate cut prospects

FMC plunges 33.5% on lower quarterly revenue forecast Alphabet falls 7.3% after downbeat earnings, heavy AI spend Indexes up: Dow 0.71%, S&P 0.39%, Nasdaq 0.19%

2025/02/04

Trump in no hurry to talk to Xi amid new tariff war

'That's fine,' Trump says of China's retaliatory duties Additional 10% tariff takes effect on China exports to US China imposes limited tariffs on smaller set of US imports China starts anti-monopoly investigation into Google Beijing imposes controls on metals exports

2025/02/04

Palantir shares jump on upbeat revenue outlook as businesses adopt AI

Feb 4 (Reuters) - Palantir (PLTR.O), opens new tab shares rallied over 18% in premarket trading after it forecast upbeat annual revenue fueled by strong demand for its software and data analytics services from businesses racing to adopt generative AI. Palantir, which provides services to governments such as software that visualizes army positions, is set to gain about $35 billion in market capitalization, at current share price levels of $99.31.

2025/02/03

Trump tariff headlines spur volatility surge across markets

Tariffs news triggers investor risk aversion. Currency markets sees significant fluctuations

2025/02/03

Trump tariffs trigger stocks slump, dollar rise on trade war fears

European futures drop as Canada, Mexico retaliate Trump slaps 25% tariffs on Canada, Mexico; 10% on China US dollar hits record high vs yuan Mexican peso, Canadian dollar tumble Hang Seng drops flat after holiday, mainland markets shut

2025/02/02

Wall Street girds for market impact of Trump tariffs

Canada, Mexico vow retaliation Stocks, high risk assets at risk Trump can increase size, scope of tariffs

2025/02/02

Wall St Week Ahead Tech sell-off jolts investors as jobs data looms

NEW YORK, Jan 31 (Reuters) - U.S. investors rattled by this week's sharp tech sell-off will closely watch upcoming jobs data for signs of continued economic resilience, which could fuel inflationary concerns already stoked by President Donald Trump's policies. The January nonfarm payrolls report due next week will signal whether the labor market remains buoyant despite high borrowing costs. The Federal Reserve left interest rates unchanged on Wednesday, citing a strong economy and inflation still above its 2% target.

2025/01/31

Wall St ends lower as White House says Trump to implement tariffs

Apple ends slightly lower a day after reporting results Chevron falls after missing Q4 results estimates Tariff announcement hits stocks Indexes: Dow down 0.8%, S&P 500 down 0.5%, Nasdaq down 0.3%

2025/01/31

Morning Bid: Higher dollar braces for tariffs, Apple rallies

A look at the day ahead in U.S. and global markets from Mike Dolan As a hectic January ends, world markets continue to brace for U.S. import tariff rises as soon as this weekend - lifting the dollar in anticipation as interest rates in Europe tumble. Despite the currency market anxiety, stocks pushed higher - with index futures adding to Thursday's Wall Street gains as the world's most valuable company Apple rallied 4% ahead of today's bell. Apple's upbeat outlook overnight impressed even in the face of a slight quarterly earnings miss.

2025/01/30

Intel's quarterly revenue tops expectations as investors await new CEO

Jan 30 (Reuters) - Intel (INTC.O), opens new tab on Thursday posted December-quarter results that beat analysts' low expectations, while its forecast for current-quarter revenue missed estimates as the chipmaker grapples with tepid demand for its data center chips and as investors wait for a new CEO. Shares of the Santa Clara, California-based company climbed 3.8% in after-hours trading. Last year, Intel's shares lost about 60%. The company's quarterly results and forecast were overshadowed by questions about its long-term strategy and efforts to replace former CEO Pat Gelsinger, who was ousted last month. Two interim co-CEOs currently run the former No. 1 U.S. chipmaker which is struggling to catch up to its rivals, especially AI chip maker Nvidia. (NVDA.O)

2025/01/30

Indexes end up as investors weigh earnings; tariff talk a damper

UPS down after lower-than-expected 2025 revenue forecast Microsoft forecast disappoints Indexes: Dow up 0.4%, S&P 500 up 0.5%, Nasdaq up 0.3%

2025/01/29

Wall Street ends down but off day's lows; Fed holds rates steady

Tech leads day's decline; Nvidia down 4.1% Fed holds interest rates steady Indexes: Dow down 0.3%, S&P 500 down 0.5%; Nasdaq down 0.5%

2025/01/29

HEDGE FLOW Stock hedge funds post big one-day drop in DeepSeek rout, say Goldman data

LONDON, Jan 29 (Reuters) - Hedge fund stock-pickers lost billions of dollars on Monday in a rout in global technology shares sparked by the emergence of a low-cost Chinese artificial intelligence model, according to a Goldman Sachs trading update and industry figures on Tuesday. Hedge funds that pick stocks based on company fundamentals rather than using algorithms to trade systematically were down 1.1% Monday, as markets sank, Goldman's trading desk said, a significant one-day drop for funds that in a good year like 2024 make 15%.

2024/01/28

Nasdaq leads Wall St higher, tech shares recover from Monday's sell-off

Royal Caribbean rises on higher-than-expected profit forecast S&P 500 tech sector registers biggest daily gain since July 31 Indexes: Dow up 0.3%; S&P 500 up 0.9%; Nasdaq up 2%

2025/01/28

Nvidia short bets rake in over $6 billion in profits after DeepSeek panic

Jan 28 (Reuters) - Short sellers of artificial intelligence-related stocks raked in bumper profits after the smashing debut of low-cost AI models from China's DeepSeek spooked Wall Street, with bets against Nvidia yielding record profits totaling more than $6 billion. Traders betting against AI-darling Nvidia (NVDA.O), opens new tab earned profits of about $6.6 billion - the biggest single-day move ever on the stock - according to data analytics firm Ortex.

2025/01/27

Nasdaq drops 3% as China's DeepSeek AI model hits tech shares

Wall Street's 'fear gauge' jumps Nvidia falls after China's DeepSeek sparks AI market rout Indexes: Dow up 0.7%; S&P 500 down 1.5%; Nasdaq down 3.1%

2025/01/27

China's DeepSeek sparks AI market rout

NEW YORK/LONDON, Jan 27 (Reuters) - Technology shares around the world slid on Monday as a surge in popularity of a Chinese discount artificial intelligence model shook investors' faith in the AI sector's voracious demand for high-tech chips. Startup DeepSeek has rolled out a free assistant it says uses lower-cost chips and less data, seemingly challenging a widespread bet in financial markets that AI will drive demand along a supply chain from chipmakers to data centres.

2025/01/24

US dollar posts biggest weekly loss since November 2023 on tariff angst

Dollar slides after Trump softens stance on China tariffs Chinese stocks get boost from Trump comments Yen volatile after expected rate hike from BOJ

2025/01/24

Wall St set for lower open with focus on economic data; Boeing declines

Boeing down on warning of bigger-than-expected Q4 loss Verizon rises on higher-than-expected Q4 subscriber additions American Express falls after Q4 results S&P January PMI data awaited Futures off: Dow 0.23%, S&P 500 0.17%, Nasdaq 0.17%

2025/01/23

S&P 500 notches closing record with focus on Trump comments, earnings

Jan 23 (Reuters) - The benchmark S&P 500 rose to a record closing high on Thursday, as investors assessed a mixed bag of corporate earnings and digested comments from President Donald Trump, including a call for cuts in interest rates and oil prices. At the World Economic Forum in Davos, Switzerland, Trump demanded that OPEC lower oil prices and that central banks reduce interest rates, while he warned global business leaders they will face tariffs for products made outside of the U.S.

2025/01/23

EA shares slump after soccer game misses goal

Jan 23 (Reuters) - Electronic Arts shares (EA.O), opens new tab sank more than 15% on Thursday, tripped up by a surprise slowdown in spending on the soccer franchise that has shaped its gaming empire. The videogame maker debuted its newest soccer title, "FC 25", in September, the latest in a series of top sellers. But this version did not get the warm reception its predecessors did, denting revenue in the live services segment, EA's biggest earner.

2025/01/22

Global industrial, tech stocks rally on Trump's AI investment push

MILAN/PARIS, Jan 22 (Reuters) - Global industrial and technology stocks including Oracle and Schneider Electric rallied on Wednesday after U.S. President Donald Trump unveiled a massive artificial intelligence investment push. Trump on Tuesday announced a private-sector investment of up to $500 billion to fund AI infrastructure, sparking interest in stocks that help build the architecture behind the technology. Oracle (ORCL.N), opens new tab, one of the companies involved in the effort, jumped more than 9.5% in U.S. early market trading. Other AI-linked firms in the U.S. including chip giant Nvidia (NVDA.O), opens new tab, Broadcom (AVGO.O), opens new tab and Arm gained between 2% and 6.5%.

2025/01/22

Morning Bid: They do know Stargate is sci-fi, right?

A look at the day ahead in European and global markets from Stella Qiu Day two of Donald Trump's second presidency culminated in an announcement that OpenAI, SoftBank Group (9984.T), opens new tab and Oracle (ORCL.N), opens new tab will form a venture called Stargate and invest $500 billion in AI infrastructure across the United States, though how much of that was already long planned is anyone's guess. It shares its name with a 1994 sci-fi movie and long-running TV series, in which Stargate is a device providing instantaneous travel between distant planets.

2025/01/21

Trump's first day in office gets mixed reception from US stocks

Jan 21 (Reuters) - Tesla, prison operators and other notable "Trump trades" were volatile on Tuesday as investors assessed a blitz of executive orders by President Donald Trump within hours of taking the oath of office. Trump laid out sweeping plans to maximize oil production, curb immigration and impose tariffs as he started his second term as the U.S. president on Monday. Some "Trump trades", or bets on what the president will do, rose on Tuesday while others tumbled as investors braced for more volatility under Trump 2.0.

2025/01/20

Trump's new meme coin soars on his first day in office, lifts other tokens

Trump meme coin soars in value Launches raise regulatory and ethical concerns, analysts say Trump company says Trump won't be involved in family businesses Bitcoin's price rallies, sets record

2025/01/17

Stocks rally to close out strong week, await Trump policies

Barclays lifts PTs on Nvidia, Broadcom Qorvo surges on Starboard stake Intel climbs on takeover speculation Indexes up: Dow 0.78%, S&P 1%, Nasdaq 1.51%

2025/01/16

Wall Street slips after rally as earnings, data eyed

Morgan Stanley up after higher Q4 profits UnitedHealth falls on missing quarterly sales estimates Investors parse retail sales, jobless claims data Indexes off: Dow 0.16%, S&P 0.21%, Nasdaq 0.89%

2025/01/16

Wall Street could get a boost from $1 trillion in buybacks, Goldman says

LONDON, Jan 16 (Reuters) - Investors have been hoping Donald Trump's return to the White House next week will boost the U.S. stock market, while Goldman Sachs sees stocks benefiting from the biggest expected company buybacks in at least five years. A corporate repurchase window, when companies can buy their own stock, begins Jan 24. Goldman strategist Scott Rubner told clients in a note sent on Wednesday and seen by Reuters on Thursday that companies that make up 45% of the value of the entire S&P 500 (.SPX), opens new tab could be allowed to buy back their shares.

2025/01/15

Wall St surges as inflation data, bank earnings fuel rally

US consumer prices rise slightly above expectations in Dec JPMorgan, Wells Fargo, Goldman Sachs post higher Q4 profits Israel, Hamas reach peace deal to end Gaza war, officials say Indexes up: Dow 1.65%, S&P 500 1.83%, Nasdaq 2.45%

2025/01/15

US SEC sues Elon Musk over late disclosure of Twitter stake

SEC says Musk profited at other investors' expense Musk's lawyer says billionaire did nothing wrong Musk has suggested disclosure delay was a mistake

2025/01/14

S&P 500 edges higher, Nasdaq dips in choppy session as inflation data eyed

US producer prices rise moderately in December Boeing dips following low 2024 jet deliveries report Eli Lilly falls after weak sales forecast for weight-loss drug Dow up 0.52%, S&P 500 up 0.11%, Nasdaq down 0.23%

2025/01/13

Stocks mostly ease as yields rise; investors weigh rate cut outlook

Nasdaq ends lower, S&P 500 ends up slightly Investors lower expectations on Fed easing in 2025 Market watchers await US CPI data, due Wednesday

2025/01/10

Treasury yields rise, stock falls pressured by stronger-than-expected US jobs data

Wall Street stocks trade lower U.S. yields hit highest since November 2023 European shares finish down U.S. dollar index reaches highest since November 2022 Crude prices jump after U.S. unveils fresh Russia sanctions

2025/01/10

US insurers slump as Los Angeles wildfire loss estimates hit $20 billion

Estimates for insured losses rise as LA wildfires continue Analysts see U.S. insurers reevaluating California pricing Forecast for total economic losses as high as $150 bln California's Insurance Commissioner uses moratorium powers to protect homeowners

2025/01/09

Swiss central bank sees 2024 profit at record $88 billion as gold, stock prices jump

Highest profit since central bank set up in 1907 Big gains for stocks and gold boost result First shareholder, government payouts since 2022

2025/01/09

Fed can soothe Trump or Treasuries, not both

LONDON, Jan 9 (Reuters) - Extreme bond market agitation has put the Federal Reserve in a bind. It can either cool long-term inflation fears or acquiesce to President-elect Donald Trump's complaints about interest rates being "far too high." It can't do both and will likely opt to tackle the former, potentially setting up a running verbal battle with the White House over the coming year. The surge in U.S. Treasury borrowing rates in the first weeks of 2025 can no longer be dismissed as just natural ebb and flow around the latest economic updates.

2025/01/08

Gold climbs after weaker-than-expected private payrolls data

Dec Fed minutes show uncertainty about Trump policies to cloud economic outlook US nonfarm payrolls report due on Friday Fed's Waller: More cuts likely though timing depends on inflation progress

2025/01/08

Tariffied? Markets feeling the most pinch from Trump tariff risks

LONDON, Jan 8 (Reuters) - From China to Europe, Canada to Mexico, world markets are already reeling from Donald Trump's promise to jack up tariffs when he becomes U.S. president in less than two weeks. Trump has pledged tariffs of as much as 10% on global imports and 60% on Chinese goods, plus a 25% import surcharge on Canadian and Mexican products, duties that trade experts say would upend trade flows, raise costs and draw retaliation.

2025/01/07

Stocks fall, US yields rise after strong US data

Wall Street stocks finish lower European stocks rise for second-straight session Benchmark 10-year Treasury yields hit eight-month high US dollar index rises Oil prices settle higher

2025/01/07

Gold pares gains as dollar rebounds following US jobs data

Dollar was up 0.3% Job openings rose 259,000 to 8.098 million by last day of Nov. US non-farm payrolls report due on Friday

2025/01/07

Aurora shares jump after deal with Nvidia, Continental to deploy self-driving trucks

Jan 7 (Reuters) - Aurora Innovation's (AUR.O),shares rose 35% on Tuesday after the self-driving technology developer announced a long-term deal with Nvidia and Germany's Continental to deploy driverless trucks. Uber (UBER.N), -backed Aurora's stock has nearly doubled in the past 12 months, as investors bet that the market for autonomous driving technology used in trucks will grow rapidly in the coming years. Pittsburgh, Pennsylvania-based Aurora is set to add about $4 billion to its market value if gains hold. As of last close, the company had a market valuation of $11.17 billion.

2025/01/06

CES Nvidia CEO set to take stage at CES just after shares hit record high

Jan 6 (Reuters) - Nvidia (NVDA.O), opens new tab Chief Executive Jensen Huang is set to deliver the opening keynote speech at CES later on Monday and will likely unveil new videogame chips and detail efforts to parlay the company's success in artificial intelligence into other markets outside of the data center. Huang typically uses CES as a platform to announce new videogame chips and unveil a flurry of new plans to expand its AI business.

2025/01/06

Stocks rise, dollar drops after Trump denies tariff policy pullback

S&P 500 and Nasdaq finish higher European stocks and currencies rally U.S. dollar index falls Crude prices settles lower

2025/01/06

U.S. Steel, Nippon sue Biden administration over decision to block merger

Biden blocked proposed deal on national security grounds Lawsuit alleges Biden influenced national security review for political reasons Separate lawsuit filed against USW president, rival Cleveland-Cliffs and its CEO

2025/01/05

Wall St Week Ahead US jobs report poses first big stocks test of 2025

Investors seek stable economy to support 2025 equity gains Labor market data crucial for Fed's interest rate plans December jobs report expected to show 150,000 job growth

2025/01/03

Fannie Mae, Freddie Mac shares surge after federal agencies reveal privatization path

Treasury, FHFA set framework for orderly release Agencies will seek to consult with the President Ackman anticipates potential listing in 2026

2025/01/03

Wall St rises on tech boost, policy changes in focus

U.S. Steel drops after Biden halts Nippon Steel's takeover plan Liquor stocks fall after US surgeon general's warning Manufacturing PMI rises to nine-month high in Dec Indexes up: Dow 0.43%, S&P 500 0.81%, Nasdaq 1.24%

2025/01/02

Wall Street ends lower on first trading session of 2025; Tesla weighs

Weekly jobless claims at 211,000, below estimates Tesla slides after deliveries data Crypto stocks rise along with Bitcoin Energy follows oil higher on China optimism Indexes down: Dow 0.36%, S&P 0.22%, Nasdaq 0.16%

2025/01/02

Nvidia's market value gets $2 trillion boost in 2024 on AI rally

Jan 2 (Reuters) - Nvidia (NVDA.O), opens new tab emerged as the biggest global gainer in market capitalization for 2024, driven by surging interest in artificial intelligence and the robust demand for its AI-centric chips across various industries. The chipmaker's market value increased by over $2 trillion last year, reaching $3.28 trillion at the close of 2024, making it the second-most valuable listed company in the world. Its market value was $1.2 trillion at the end of 2023.

2024/01/31

Wall Street ends lower, capping a banner year

U.S. stock indexes post annual, quarterly gains S&P 500 posts biggest two-year gain since 1997-98 Indexes off: Dow 0.07%, S&P 500 0.43%, Nasdaq 0.90%

2024/12/30

Wall Street ends sharply lower on penultimate trading day of a strong 2024

Crypto stocks drop Boeing dips as South Korea begins crash investigation U.S. stock markets closed on Jan 9 (Thursday) Indexes down: Dow 0.97%, S&P 500 1.07%, Nasdaq 1.19%

2024/12/30

Jeju Air shares plummet to record low after deadly plane crash

SEOUL, Dec 30 (Reuters) - Shares of South Korean budget carrier Jeju Air (089590.KS), opens new tab hit their lowest on record on Monday, after the deadliest air crash in the country killed 179 people. Jeju Air shares traded down 8.5% as of 0312 GMT, after falling as much as 15.7% earlier in the session to 6,920 won, the lowest since they were listed in 2015. The share slide on Monday wiped out as much as 95.7 billion won ($65.2 million) in market capitalisation.

2024/12/29

Wall St Week Ahead Trump's first actions and job data to test market in January

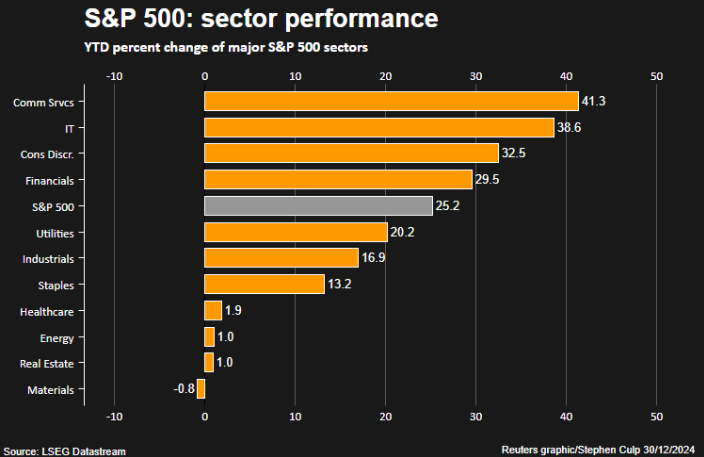

NEW YORK, Dec 27 (Reuters) - After closing the books on a banner year for U.S. stocks, investors expect to ride seasonal momentum into mid-January when a slew of economic data and a transition of power in Washington could send markets moving. The S&P 500 (.SPX), opens new tab rose roughly 25% in 2024 through Dec. 27, while the technology-heavy Nasdaq Composite index <.IXIC >, which surpassed 20,000 for the first time in December, is up over 31%.

2024/12/27

Stocks hit, dollar slips in illiquid year-end profit taking

Wall Street indexes skid on year end profit taking, tax harvesting U.S. dollar set for 7% annual gain, yen faces fourth year of losses Thin markets exacerbate moves before another abbreviated week

2024/12/26

Dow ends up to extend win run to five; rising yields pressure megacap stocks

Weekly jobless claims at 219,000, below estimates Crypto stocks fall tracking losses in bitcoin Yield on U.S. 10-year Treasuries hits highest since May Indexes: Dow up 0.07%, S&P 500 down 0.04%, Nasdaq off 0.05%

2024/12/24

Wall Street ends higher as Santa rally begins

Markets close at 1 p.m. ET in holiday-shortened session Dow, Nasdaq take win streaks to four; S&P up for third straight Crypto-related stocks climb as bitcoin gains Benchmarks higher on first day of Santa Claus rally Indexes up: Dow 0.91%, S&P 500 1.1%, Nasdaq 1.35%

2024/12/24

Global shares and dollar firm in muted pre-Christmas trade

Stocks rise in holiday trading conditions Dollar, US yields steady near milestone highs Chinese authorities pledge more support for economy Fed outlook remains top of investors' minds

2024/12/23

How investments may fare during Trump 2.0 and Fed easing

Investors expect US economic exceptionalism to persist in 2025 Fed's rate cut pace crucial for stock momentum Strong dollar could challenge US multinationals and global inflation efforts

2024/12/23

Markets in 2024: Wall Street's high-octane rally keeps investors captive to the US

U.S. stocks heading for their second annual gain exceeding 20% Markets exposed to shocks on U.S. rate path, Trump policies European stocks tipped for 2025 rebound, gold shines Bonds set for another challenging year despite rate cuts

2024/12/22

Oil prices fall on demand concerns, strong dollar

BEIJING, Dec 20 (Reuters) - (This December 19 story has been corrected to remove the reference to China's imports peaking as soon as 2025 in paragraph 3) Oil prices fell in early trading on Friday on worries about demand growth in 2025, especially in top crude importer China, putting global oil benchmarks on track to end the week down more than 2%. Brent crude futures fell by 31 cents, or 0.43%, to $72.57 a barrel by 0139 GMT. U.S. West Texas Intermediate crude futures fell 26 cents, or 0.26%, to $69.12 per barrel.

2024/12/22

Wall St Week Ahead Investors hope for 'Santa Claus' rally as stocks lose steam

Benchmark 10-year Treasury yields at highest level in over 6 months 8 of the 11 S&P 500 sectors in negative territory in December S&P 500 trading on forward earnings estimates well above historical average

2024/12/20

US stocks end sharply higher, dollar drops after inflation report

U.S. stocks turn higher after PCE report Lawmakers work to avoid partial government shutdown Gold rallies, dollar softens U.S. stock indexes on track for weekly losses

2024/12/20

Gold climbs after soft US inflation data; still set for weekly loss

Gold down 0.9% so far this week U.S. PCE data shows monthly inflation slowed in November

2024/12/19

Stocks end flat after Fed-induced selloff as early bounce fades

Micron, Lennar fall after results Banks firm as U.S. bond yields rise Q3 GDP revised higher Dow up 0.04%, S&P down 0.09%, Nasdaq off 0.10%

2024/12/18

Brazil's real hits record low as markets eye govt spending

Brazil's real posts largest daily decline since November 2022 Brazilian markets hit by strong US dollar after Fed cuts rates but signals caution

2024/12/17

Stocks fall, Dow drops for 9th straight session with Fed decision due

November retail sales stronger than expected Pfizer up after in-line 2025 profit forecast Dow on pace for ninth straight day in the red Indexes off: Dow 0.61%, S&P 500 0.39%, Nasdaq 0.32%

2024/12/16

EM has no easy escape from dollar squeeze

ORLANDO, Florida, Dec 13 (Reuters) - A strong U.S. dollar and high Treasury yields are posing significant challenges for emerging economies, and policymakers have no easy way to counter this powerful one-two punch. With American exceptionalism casting a shadow over the rest of the world, many emerging markets (EM) are facing weaker currencies, increased costs to service dollar-denominated debt, depressed capital flows or even capital flight, dampened local asset prices and slowing growth.

2024/12/13

Wall St Week Ahead Fed rate view in focus as robust stocks year draws to close

Fed widely expected to cut rates by 25 bps on Wednesday Some investors brace for "hawkish cut," with Fed suggesting pause in easing cycle S&P 500 up 27% in 2024, with Nasdaq breaching 20,000 as latest equities milestone

2024/12/12

Global cenbank liquidity - from market headwind to tailwind?

ORLANDO, Florida, Dec 12 (Reuters) - One of the many curiosities of 2024 has been how global stocks have surged so strongly even as central banks have drained liquidity from the system. The question for markets is, if draining liquidity wasn't much of a headwind this year, will its likely reversal next year turn into a tailwind?

2024/12/11

Stocks cheered Trump's victory, but tariffs bring unknowns to 2025

Barclays: Tariffs may cut S&P 500 earnings by 2.8%, hit materials, consumer sectors Tariffs also could increase inflation measures in 2025, analysts estimate Investors recall 2018 trade war impacts, defensive stocks outperformed, tech underperformed

2024/12/09

FX markets brace for G10 policy blitz: McGeever

ORLANDO, Florida, Dec 9 (Reuters) - An extraordinary year for investors is poised to end with a monetary policy bang, with almost every G10 central bank scheduled to deliver interest rate decisions over a 10-day period this month. Four of the G10 central banks meet this week and five, including the Federal Reserve, meet next week. Remarkably, four of those - Bank of Japan, Bank of England, Riksbank and Norges Bank - will deliver their policy verdicts on the same day, Thursday December 19.

2024/12/09

Global, US stocks fall; oil, gold rise over 1% on geopolitical risk

Oil, gold prices gain South Korea stocks skid; Wall St down ECB, SNB and BoC all seen cutting rates this week

2024/12/09

Morning Bid: Markets keep calm as Syria falls in a rush

A look at the day ahead in European and global markets from Wayne Cole If you are wondering how markets have reacted to the stunning fall of President Bashar al-Assad in Syria, the answer is calmly. Gold and oil prices are up around 0.4%, but that's a modest move for such a rapid turn of events and there are no signs of a rush to safety. Maybe there's just too much going on in the Middle East for traders to know how to react.

2024/12/06

S&P 500, Nasdaq hit record closing highs; Lululemon gains, data supports rate cut view

November nonfarm payrolls above estimates at 227,000 Ulta Beauty gains after raising annual profit forecast Lululemon Athletica up following upbeat annual forecast Indexes: Dow down 0.3%, S&P 500 up 0.3%, Nasdaq up 0.8%

2024/12/06

Oil prices fall on supply glut fears despite OPEC+ output cut extension

Brent and WTI both down more than 1%, post weekly loss Even with OPEC+ restraint, analysts see oversupply in 2025 US drillers add oil and gas rigs for first time in 8 weeks US job growth rebounds in November; unemployment rate rises

2024/12/06

Wall St Week Ahead Inflation report poses test for stocks rally as Fed meeting looms

Wednesday data expected to show 2.7% annual rise in CPI S&P 500 up more than 27% so far in 2024 Fed rate cut expected at meeting in wake of jobs report

2024/12/06

Cash draws biggest weekly inflow since March 2023, BofA says

LONDON, Dec 6 (Reuters) - Investors ploughed $136.4 billion into cash in the week to Wednesday, the biggest weekly inflow since March 2023, when markets were rattled by a regional banking crisis, according to a report from Bank of America on Friday. They also snapped up $8.2 billion of stocks and $4.9 billion of bonds, but sold $0.4 billion of gold, Bank of America said, citing data from EPFR.

2024/12/05

Wall Street stocks, bitcoin take breath from record highs ahead of US jobs data

Bitcoin crosses $100,000 but pulls back slightly World stocks hold near record highs French government collapses, euro holds up Dollar dips, Treasury yields steady

2024/12/05

GameStop jumps after cryptic post from 'Roaring Kitty' rekindles retail hype

Dec 5 (Reuters) - GameStop's (GME.N), shares jumped on Thursday after a cryptic post from meme stock influencer Keith Gill, who shot to notoriety after his online personas and bullish bets on the video game retailer sparked a trading frenzy among mom-and-pop investors.

2024/12/05

Experts react to bitcoin's $100,000 milestone

Dec 5 (Reuters) - Bitcoin hit a record high above $100,000 on Thursday as the election of Republican Donald Trump as U.S. president fuels expectations that his administration will usher in a friendly regulatory environment for cryptocurrencies.

2024/12/05

Morning Bid: Bitcoin's clean break

A look at the day ahead in European and global markets from Tom Westbrook One bitcoin will now set you back six figures. The cryptocurrency's break above the $100,000 milestone has felt inevitable since Donald Trump's election as the next U.S. president on a crypto-friendly platform. While it is just a number, it highlights how cryptos have carved out a place in modern financial markets.

2024/12/04

Tech rally, Powell comments boost indexes to record closing highs

Powell says Fed can afford to be a little more cautious Salesforce jumps after beating Q3 revenue estimates November ADP private payrolls at 146,000 versus 150,000 estimate Indexes: Dow up 0.7%, S&P 500 up 0.6%, Nasdaq up 1.3%

2024/12/04

Salesforce shares scale record high on promising AI tools

Dec 4 (Reuters) - Salesforce (CRM.N), shares climbed about 11% to a record high on Wednesday after the customer relationship management software maker topped quarterly sales estimates and provided an upbeat forecast for its newly launched AI-integrated products.

2024/12/04

Morning Bid: Powell tees up after S.Korea jars, France waits

A look at the day ahead in U.S. and global markets from Mike Dolan A bizarre 24-hour period in which the world's 12th-biggest economy briefly introduced martial law left markets pondering geopolitical risks next year while awaiting a casting vote, or at least a steer, on whether the Federal Reserve eases this month.

2024/12/03

Morning Bid: Wall St at records as Paris simmers, yuan hits 2024 low

A look at the day ahead in U.S. and global markets from Mike Dolan Wall Street stocks are grinding out new records as U.S. growth continues to outperform, interest rate cut optimism has been rekindled at the margins and investors raise eyebrows at overseas turbulence in French politics and Chinese trade.

2024/12/02

Gold drops as strong dollar sours four-session rally; Fed in focus

Dollar up 0.7%, set for it best day in nearly 4 weeks Expect choppy, consolidative gold market into year-end - analyst Most brokerages see 25-bps rate cut in December US ADP employment report, non-farm payrolls due this week

2024/12/02

Tesla leads November's global market value surge

Dec 2 (Reuters) - Tesla's (TSLA.O), market capitalisation increased by the most among top global companies in November, boosted by expectations the automaker will benefit from CEO Elon Musk’s close ties with U.S. President-elect Donald Trump.

2024/12/01

Morning Bid: Trump's BRICS warning shines light on emerging FX

Dec 2 (Reuters) - A look at the day ahead in Asian markets. The global market spotlight on Monday looks set to zoom in on the dollar, especially its performance against emerging market currencies, after U.S. President-elect Donald Trump's weekend warning against the so-called 'BRICS' nations.

2024/12/01

Wall St Week Ahead Jobs data set to pave way for rates path, stocks

US nonfarm payrolls report for Nov due on Dec 6 Market bets for Dec Fed meeting lean to 25 bp cut S&P 500 hovers at records, P/E ratio at over 3-yr highs

2024/11/30

Trudeau visits Florida to meet Trump amid tariff threat

WEST PALM BEACH, Florida, Nov 29 (Reuters) - Canadian Prime Minister Justin Trudeau visited Donald Trump's Florida resort on Friday to meet with the U.S. President-elect, days after Trump threatened to slap tariffs on Canadian imports over border-related concerns.

2024/11/29

Rupee logs worst month since March as Trump win lifts dollar, outflows persist

MUMBAI, Nov 29 (Reuters) - The Indian rupee ended November with its worst monthly performance in eight, as Donald Trump's victory in the U.S. election boosted the dollar and U.S. bond yields, while foreign portfolio outflows persisted.

2024/11/28

European stocks perk up as markets slow for Thanksgiving

Tech shares boost European stocks South Korean central bank cuts interest rates Oil ticks up as Israel says ceasefire with Hezbollah breached