Jan 3 (Reuters) - Wall Street's main indexes moved higher on Friday as technology stocks rebounded from a losing streak, while investors geared up for potential policy shifts under the incoming Trump administration.

At 10:05 a.m. ET, the Dow Jones Industrial Average (.DJI) rose 181.31 points, or 0.43%, to 42,569.94, the S&P 500 (.SPX) gained 47.44 points, or 0.81%, to 5,915.99 and the Nasdaq Composite (.IXIC) gained 236.31 points, or 1.24%, to 19,519.58.

All 11 S&P 500 sectors were trading in positive territory, with the information technology sector (.SPLRCT) bouncing back 1.3% after falling for the past four sessions. Nvidia (NVDA.O) was driving gains on all three major indexes.

Wall Street had a dour start to the new year, with the S&P 500 and Nasdaq erasing early gains to close lower for a fifth straight session on Thursday, bucking a historical trend where markets rally in the last five sessions of December and the first two sessions of January.

All three major indexes were on track to log weekly declines of about 1% each.

Analysts have highlighted uncertainty surrounding the policies that President-elect Donald Trump's administration might roll out, especially with his Republican party holding sway over Congress. The newly elected Congress will begin its first session on Friday, with Trump set to take the oath of office on Jan. 20.

Trump's proposals, ranging from slashing corporate taxes and easing regulations to imposing tariffs and curbing illegal immigration, could boost corporate profits and energize the economy. However, they also pose certain risks

"The main issue people will start focusing on is, if his (Trump's) decisions will be inflationary and if they are, does that signal that the Fed will do an abrupt course change and start raising rates." said Peter Andersen, founder of Andersen Capital Management.

Traders now expect the Federal Reserve to lower rates by about 50 basis points this year, per the CME Group's FedWatch Tool.

Hindering the case for easing rates, however, data continues to suggest resilience in the economy. On Friday, data showed manufacturing moved closer to recovery in December, with production rebounding and new orders rising further.

The yield on the 10-year Treasury note remains anchored near the psychological level of 4.5%.

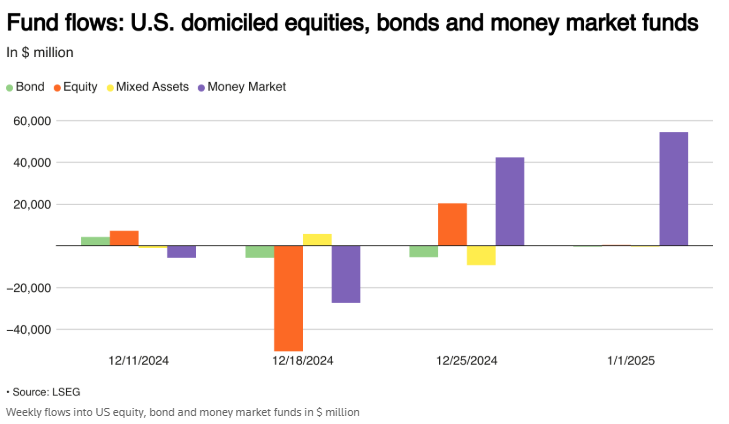

Inflows into U.S. equity funds experienced a sharp decline in the week leading up to Jan. 1.

Comments from Richmond Fed President Thomas Barkin are also on tap.

Stretched equity valuations have been a concern for investors but most brokerages expect another year of gains for U.S. stocks, propelled by strong corporate performance.

Alcoholic beverage makers such as Constellation Brands (STZ.N) dropped 1.1%, Molson Coors (TAP.N) lost 2.3%, and Brown-Forman (BFb.N) slipped 1.5%, after the U.S. surgeon general urged cancer warnings on the labels of alcoholic drinks.

U.S. Steel (X.N) slid 7.2% after President Joe Biden blocked Nippon Steel's (5401.T) proposed $14.9 billion purchase of the company.

Block (SQ.N) rose 4.7% after brokerage Raymond James raised its rating to "outperform" from "market perform".

Trading volumes are expected to be subdued following the New Year's holiday on Wednesday.

Advancing issues outnumbered decliners by a 1.68-to-1 ratio on the NYSE and by a 1.5-to-1 ratio on the Nasdaq.

The S&P 500 posted two new 52-week highs and 11 new lows while the Nasdaq Composite recorded 36 new highs and 18 new lows.